Usted está aquí

Why Hasn't Private Cord Blood Banking Grown Faster?

This simple question has been lingering unanswered over private cord blood banks around the world for years. Despite compelling data on the growing therapeutic use of cord blood, both in terms of treatable diseases and numbers of therapies, often medical doctors are still reluctant to embrace the value of family cord blood banking. In many countries, such as Brazil, this sector is still plagued with mostly unfounded controversy, such as the "public versus private" banking debate.

Hematology reviews show that there have been over 30 thousand cord blood transplants around the world to date. Confidential data archived by the Parent's Guide to Cord Blood Foundation show that by the end of 2013 there were over 3 million private cord blood units in storage and over one thousand therapies (both autologous and allogeneic) using units released from private banks.

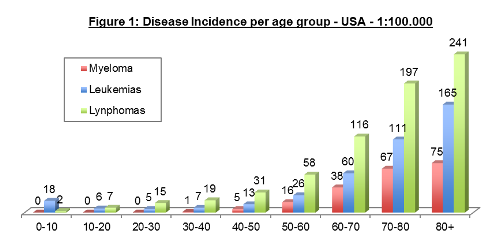

Data from the USA's National Cancer Institute (Figure 1) indicate that the odds of having cancer increase with age, so that cord blood in private banks will be increasingly useful to families only after 30 to 40 years. Currently the average age of privately stored cord blood units is between 5 and 10 years, so the likelihood of these units being used to treat cancer is still low. Indeed, according to the Parent's Guide to Cord Blood, in some parts of the world most sibling transplants released from private banks are not for cancer, but for non malignant acquired and hereditary blood disorders, especially Sickle Cell and Thalassemia.

Looking deeper into the characteristics which contribute to the slow growth of the cord blood banking sector, it is never a trivial task to sell a medical service directly to mass consumer markets, especially when your service is perceived as complicated and new. In reality, this service should not be perceived differently than other major medical innovations which required substantial time to prove themselves, after reliable data could be collected along many years.

Thus, it is natural that physicians are the key stepping stone for outreach to parents. Selling a service that is perceived as hematologic/oncologic to someone who delivers babies is also a challenge. The doctor needs to be convinced that a harmless decision such as the collection of cord blood, with apparently no immediate consequence to the baby, may become a life saving measure for that child later on. Cord blood collection needs to become one of the many precautionary measures so many Ob/Gyn's are used to prescribe, like ultra-sound examination and pre-natal care, among many others. Afterall, the likelihood of a child to need therapy with cord blood, especially for indications associated with prematurity, is not that different from many conditions potentially detected during pregnancy.

Physicians will certainly be more open to support cord blood banking if they are supplied with updated, quality, scientific evidence. Unfortunately, storing cord blood is still not a consensus from societies of medical professionals. Coupling all these challenges, those private cord blood banks that make false promises and sensationalist statements, certainly do not contribute to the credibility building process of the sector.

Hiring the right person as a sales representative ("rep") visiting physicians for a private cord blood bank is crucial. The mix of determination, selling skills, scientific curiosity and sense of purpose is not an easy one to find. Keeping the reps continuously motivated requires somewhat of a preachers' approach. These professionals need to buy in to the cord blood banking concept at a very deep philosophical level, realizing they do sell a service that may cure cancer, and this is a big deal! This will be the key pillar which will keep them focused, day in and day out, when they wake up early, often to hear derogatory comments from poorly informed doctors who may ridicule or discredit what they do.

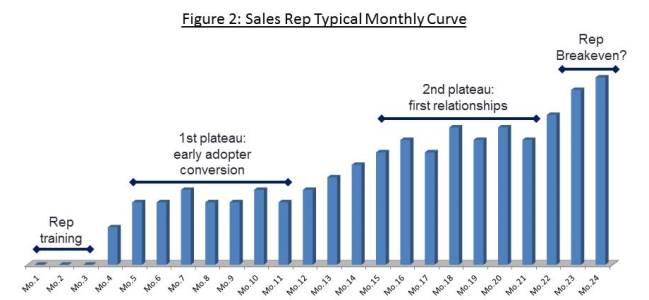

The private bank must make a long term commitment to the sales rep model, as it takes at least 24 months for reps to payback their cost (Figure 2). There are four distinct stages a rep goes through until they reach their breakeven point, where the rep is generating enough revenue to cover their cost. First, due to the training complexity of private cord blood banking, it normally takes around three months for a rep to generate their first sales. Fairly quickly after that, a small group of doctors, namely early adopters, normally start referring new clients. Evolving to the next stage, when actual long term relationships are established, can take up to one more year or sometimes may not happen at all. This is the most important step for a rep to overcome, which will come to prove them as an effective relationship builder. Expanding this initial portfolio of loyal doctors is slow; literally a process of converting one doctor at a time.

In addition to personal visits to physicians by sales reps, private cord blood banks may apply internet marketing strategies that reach customers directly with little cost, and thus lower the aquisition cost per customer. Internet marketing strategies include social media outreach and targeted advertising.

Maintaining a loyal portfolio of doctors, however, does not depend solely on the continuous efficiency of the rep's work. It is imperative that the private cord blood bank as an organization (sales, operations, laboratory, customer service, etc...) consistently delivers on it's promises. A fair analogy is that of a good restaurant, whose greatness starts inside the kitchen, first and foremost, and not primarily because of marketing buzz. One final note, based on our experience, is that clients are loyal to a brand and are not a rep's property to be transfered from company to company, wherever the rep chooses to work.

In summary, the combination of all factors mentioned above explain why private cord blood banking may be an enticing sector for investment, but a challenging one when it comes to growth. The reason is fairly simple: it is difficult and expensive to sell this service.