Jesteś tutaj

Consolidation of Family Cord Blood Banks

Everyone agrees that the family cord blood banking industry is consolidating, but it is hard to agree upon a quantitative metric of that consolidation. BioInformat has said, “70% of the global cord blood market is controlled by the world’s 12 largest cord blood banking operators” (Feb. 2022). FamiCord Group has said that within Europe “the number of cord blood banks has dropped by more than one-third over the past decade, from approximately 150 to less than 100” (Oct. 2022). So, do we measure consolidation in terms of the number of banks, the number of companies operating banks, or the fraction of inventory concentrated under the biggest owners? We attempt to look at all these trends. The one caveat to keep in mind is that we apply the Parent’s Guide to Cord Blood audit of banks, which may not agree with the marketing statements that banks make about themselves.

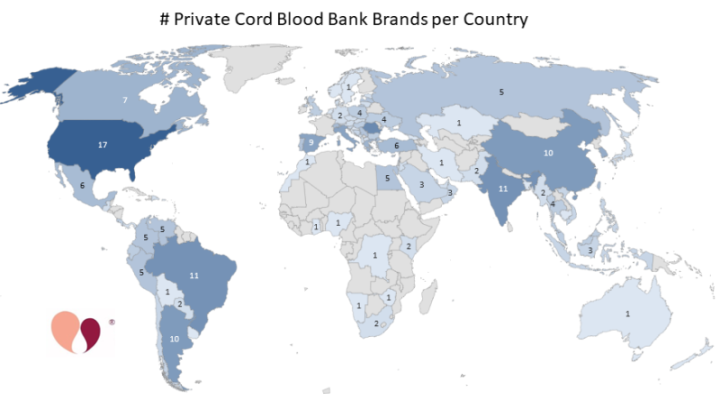

The first metric we present is a heat map of how many brands are marketing family cord blood banking in each country. To the best of our knowledge, there are 97 countries and territories which have an active brand of family cord blood banking. These brands include both banks that have a laboratory based in the country, as well as marketing offices in the country which work with a laboratory elsewhere. A half dozen countries have at least 10 brands: United States, Romania, Brazil, India, Argentina, and China.

However, this map of brands is only one way to measure the diversity of the industry. In recent years there have been many mergers and acquisitions among private cord blood banks, so that oftentimes brands that appear to be separate are in fact owned by the same parent company. For example, 4 out of 9 brands in Spain are subsidiaries of FamiCord Group, while 3 out of 6 brands in Mexico are owned by CryoHoldCo.

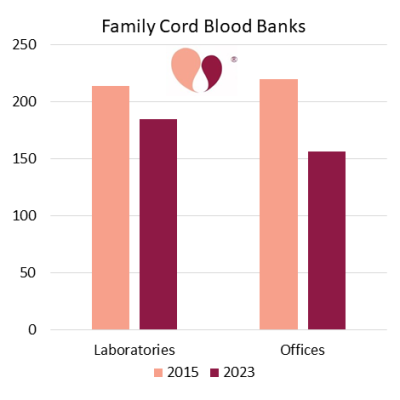

An alternate metric of consolidation is to count the number of companies that are active today, compared to our Foundation’s last industry report in 2015. For this tally we make the distinction between bank laboratories versus marketing offices. Over the last eight years, our data shows that the number of family bank laboratories has dropped by 14% from 214 to 185, while the number of offices has dropped more dramatically by 29% from 220 to 156. A large part of the drop in offices can be attributed to the bankruptcy of Cryo-Save in Europe.

An alternate metric of consolidation is to count the number of companies that are active today, compared to our Foundation’s last industry report in 2015. For this tally we make the distinction between bank laboratories versus marketing offices. Over the last eight years, our data shows that the number of family bank laboratories has dropped by 14% from 214 to 185, while the number of offices has dropped more dramatically by 29% from 220 to 156. A large part of the drop in offices can be attributed to the bankruptcy of Cryo-Save in Europe.

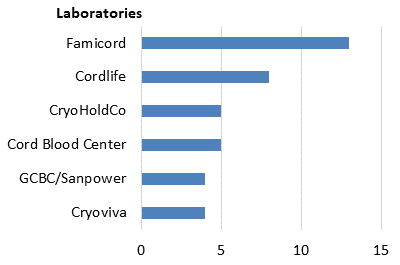

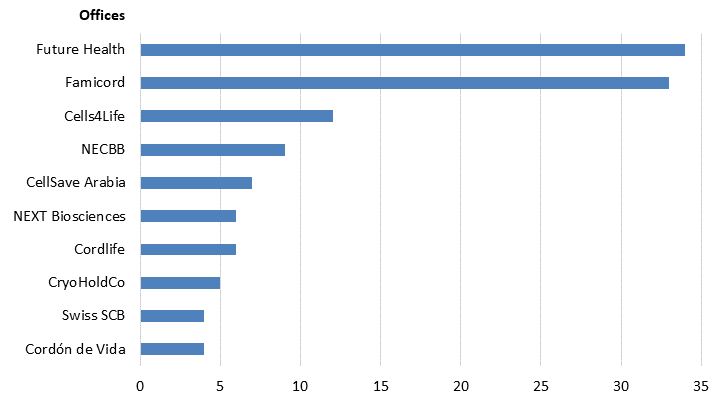

The reader may ask, how many of these laboratories and offices belong to the same owners? To answer that question, we went through all the family banking brands and assigned them to parent companies, then performed a sort. The next two graphs show the top owners of family bank laboratories and the top owners of marketing offices. We found that only six companies own four or more laboratories, and they hold 21% (39 of 185) of the total number of laboratories. The majority of the family cord blood companies, 72% (134 of 185), only have one laboratory. Whereas, ten companies own four or more offices, and they hold 77% (120 of 156) of the total number of offices.

These graphs displaying ownership of laboratories versus offices illustrate the range of business models among the companies which have built brand presence in multiple countries. On the one hand, some companies ship cord blood from a wide variety of locations to a single laboratory. Some examples of this business model are the UK banks Future Health and Cells4Life, the US bank New England Cord Blood Bank (NECBB), the Mid-East bank CellSave Arabia, and the African bank NEXT Biosciences. On the other hand, some companies maintain a laboratory in many of the countries where they do business. Some examples of this business model are the Asian bank networks Cordlife and Cryoviva. The multi-laboratory business model is sometimes required by national regulations. For example, UAE and Vietnam are two nations which recently adopted regulations which require that a family bank doing business in their country must have a laboratory within their country. Finally, there are some companies that have a blended business model which combines growth through multiple laboratories as well as multiple brand offices. Some examples are FamiCord in Europe, CryoHoldCo in Latin America, and Cordlife Group in Asia.

These graphs displaying ownership of laboratories versus offices illustrate the range of business models among the companies which have built brand presence in multiple countries. On the one hand, some companies ship cord blood from a wide variety of locations to a single laboratory. Some examples of this business model are the UK banks Future Health and Cells4Life, the US bank New England Cord Blood Bank (NECBB), the Mid-East bank CellSave Arabia, and the African bank NEXT Biosciences. On the other hand, some companies maintain a laboratory in many of the countries where they do business. Some examples of this business model are the Asian bank networks Cordlife and Cryoviva. The multi-laboratory business model is sometimes required by national regulations. For example, UAE and Vietnam are two nations which recently adopted regulations which require that a family bank doing business in their country must have a laboratory within their country. Finally, there are some companies that have a blended business model which combines growth through multiple laboratories as well as multiple brand offices. Some examples are FamiCord in Europe, CryoHoldCo in Latin America, and Cordlife Group in Asia.

Trying to calculate the total inventory in family banks and how it is distributed among owners is very difficult. It is impossible to get complete information, because some banks refuse to talk about their inventory. It is also impossible to get accurate information, because some banks insist on quoting the number of “samples” in storage as their inventory, when this quantity - including both cord blood and cord tissue, and counting multiple storage compartments - is several times higher than the number of clients. Despite these challenges, we guesstimate that family and hybrid cord blood banks currently hold at least 9.5 million units of cord blood and cord tissue. We also estimate that about 3.9 million units of that inventory is in the top three conglomerates. Number one is the four banks in China that are jointly owned by Global Cord Blood Corp and Sanpower; these banks are located in Beijing, Guangdong, Zhejiang, and Shandong. Number two is the three banks owned by CooperSurgical; these are Cord Blood Registry in the US, Insception Lifebank in Canada, and Cell Care in Australia. Number three is the combination of the FamiCord Group in Europe plus the inventory of the former Cryo-Save that is held by FamiCord.

The family cord blood banking industry is like a glass that is both half full and half empty at the same time. Those who track the financial aspect of the industry like to emphasize the growth of conglomerates that have large inventory. But the other side of the story is that family banking is active in 97 countries, most family banking companies only operate one laboratory, and new laboratories continue to be built. During the Coronavirus pandemic, there were entire countries that could not store cord blood because they could not ship the blood across their borders to laboratories in other countries. In reaction, consortiums of medical professionals in some of those countries are now seeking to develop more localized biobanking. We anticipate that more laboratories offering family cord blood banking will open in the next few years.