Jesteś tutaj

Cord Blood Banking Affordability in the USA

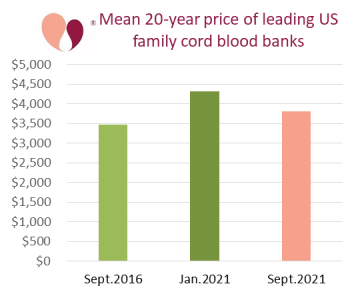

Currently, the three largest family cord blood banks in the United States have dropped their first year’s cost by more than half, to about $750, leading to net price discounts over 20 years of about 20%.

Over the five years from 2016 to 2021, the average cost for 20 years of private cord blood banking in the US rose about 24%, from $3471 to $4312. This is notably more than the 14% increase that could be attributed to cumulative inflation in the cost of consumer goods over that time1,2. At most family banks, 20-year prices have crept up through combined trends of lowering initial fees but simultaneously raising annual storage fees. At Parent’s Guide to Cord Blood Foundation, we always compare bank prices by adding up all the cumulative charges that factor into the net cost from the child’s birth to age 20 years. We chose 20 years as our cut off because this is the age often used by pediatricians to define adulthood3. Different banks may have drastically different payment plans, and it is only possible to make an apples-to-apples comparison between bank prices by looking at their net price after 20 years.

Viacord was the first family cord blood bank in the US to drastically lower their initial fees, starting at the beginning of 2021. While some industry observers interpreted this as the first salvo of a "price war", David Blackett, VP of Marketing at PerkinElmer, told the Parent’s Guide to Cord Blood Foundation that it was a corporate decision to focus on affordability.

Viacord was the first family cord blood bank in the US to drastically lower their initial fees, starting at the beginning of 2021. While some industry observers interpreted this as the first salvo of a "price war", David Blackett, VP of Marketing at PerkinElmer, told the Parent’s Guide to Cord Blood Foundation that it was a corporate decision to focus on affordability.

The penetration of cord blood banking In the United States was only about 3% of births before the Coronavirus pandemic4. Consumer surveys show that parents consider the high initial cost of family banking to be the major obstacle to participation. Those consumer surveys also predict that lowering prices, especially initial fees, will lead to significantly increased market penetration. Viacord is a subsidiary of PerkinElmer (NYSE:PKI), a global company with a broad life sciences portfolio that has current revenues of $3.8 billion5,6. Viacord can afford to significantly drop their prices in an effort to grow parent participation in cord blood banking.

Until September 2021, Viacord was the only family bank advertising a significant discount for all customers, not just select groups recruited through certain marketing partners. Finally, at the end of summer the dam broke, and all of the banks that actively market in the US started aggressively advertising discounts. At present, the average 20-year price of the leading family banks in the US market is $3811 for cord blood banking alone.

As usual in the business of marketing cord blood banking, appearances can be deceiving. Not all of the family banks that are advertising discounts have actually lowered their net prices. The three largest banks in the US have genuinely dropped their 20-year prices to almost where they were in September 2016. Of course, those banks that were already very affordably priced are offering smaller discounts. A couple of banks have actually taken advantage of this upheaval to raise their 20-year prices, by halving their initial fees like the big banks, but at the same time substantially increasing their storage fees.

Are we in the midst of a price war? It is hard to say. The slide from healthy price competition into a price war has been the topic of research by economists7. Price wars tend to occur when consumers view a product or service as a "commodity", where quality is uniform among providers so that only the price differs8. There are numerous tactics that competing companies can use to reframe the messaging about their offerings, so that consumers do not perceive the choice as simply a matter of price9.

In 2016 there was a price war among family cord blood banks in Portugal, the country which has the highest market penetration of cord blood banking in Europe, at 10% of births4. This led to a wave of consolidation, so that the number of family banks serving Portugal was cut in half. Stiff price competition can drive out banks that do not have enough cash reserves or enough investor confidence to survive taking a loss on the initial processing of new customers.

Another potential outcome of the current discounts in the US market could be a sea change in the way cord blood banking services are charged. One bank in the US, HealthBanks, has switched to a subscription plan model of cord blood pricing. Their initial fee is only $99 and thereafter they charge a service fee of $19.99/month, indefinitely. Consumers are very comfortable with subscription plans and subscribe for many of the services that they routinely use. Subscription pricing might catch on if the cord blood banks that offer subscriptions can withstand taking a substantial loss on the laboratory costs of the initial processing.

The current prices for family cord blood banking are definitely a bargain for US consumers. Hopefully more affordable cord blood banking will lead to increased market penetration, without driving out companies that offer a good value for their price. The cord blood industry has been undergoing a wave of consolidation into larger global banks for some time now, and the Coronavirus pandemic has created economic stresses that have accelerated that trend10,11.

It remains important to educate parents that cord blood banking is not just a commodity, where price is the only discriminator between banks. There are still noteworthy differences among banks. Parents need to be mindful that cord blood banking is a form of medical insurance, where the quality of the initial process and the stability of the long-term storage are very important. The Parent’s Guide to Cord Blood Foundation hopes to help cord blood banks with that education campaign.

References

- CoinNews Media Group. US Inflation Calculator. Accessed 2021-10-01

- U.S. Bureau Labor Statistics. Consumer Price Index Accessed 2021-10-01

- American Academy of Pediatrics. Supporting the Health Care Transition From Adolescence to Adulthood in the Medical Home. Pediatrics 2011; 128(1):182-200.

- Verter F. Percentage of births banking cord blood by country. Parent's Guide to Cord Blood Foundation Newsletter Published 2020-01

- PerkinElmer. Corporate Fact Sheet. Accessed 2021-10-01

- Simply Wall St. Calculating The Fair Value Of PerkinElmer, Inc. (NYSE:PKI) Yahoo! Finance. Published 2021-09-16

- Krämer A, Jung M, Burgartz T. A Small Step from Price Competition to Price War: Understanding Causes, Effects and Possible Countermeasures. International Business Research 2016; 9(3):1-13.

- Fernando J. Commodity. Investopedia Published 2021-05-26

- Rao AR, Bergen ME, Davis S. How to Fight a Price War. Harvard Business Review Published March–April 2000.

- Verter F. World’s Top 10 Cord Blood Banks by Inventory and Industry Consolidation. Parent's Guide to Cord Blood Foundation Newsletter Published 2018-11

- Hildreth C. Cord Blood Industry Consolidation Escalates in 2021. Bioinformant Published 2021-08-02 [Correction: This article states that at one time there were 450 cord blood banks worldwide, which is grossly in error. There were never more than 200 banking laboratories, and the additional 250 "banks" were marketing offices.]