Jesteś tutaj

Cord Blood Industry Report

Parent's Guide to Cord Foundation has issued the world's first Cord Blood Industry Report that is based on direct interviews of family cord blood banks around the world. All participating companies were promised confidentiality, hence their proprietary data is only presented in aggregates. The landing page of the report displays an Abstract of the contents, and the Access page explains the subscription procedure. In this article we present a preview of some interesting results.

One of the biggest inaccuracies that plagued previous reports about the cord blood industry was confusion over what constitutes a cord blood bank. We define a family cord blood "Bank" (with a capital B) as an entity that owns and operates a laboratory. It is common for a single Bank to market its services through multiple "Affiliates" in multiple countries. Collectively, there are at least 434 "Providers" (both Banks and Affiliates) of family cord blood banking worldwide, but only 214 of them are Banks.

The distinction between Banks and Affiliates matters, depending on what parameter of cord blood banking is being examined. For example, prices are set at the Provider level, whereas accreditations can only belong to the laboratory of a Bank. In our report we sometimes found differences between the average prices of Banks versus Affiliates for certain services.

Our Foundation has been publishing cord blood industry reports for over a decade, but this is the first year that we are issuing the report on a secure website through a shopping cart. Back in 2003, the Parent's Guide to Cord Blood found that, within the US, the inventory in family banks was 3.0 times larger than the inventory in public banks. A decade later in 2013, our worldwide survey of family banks counted an inventory at least 3.4 times higher than the public inventory reported by WMDA for the same time stamp. This shows that claims of wild growth in the family banking sector are a bit misleading. While family banks are active on a much larger scale than public banks, the inventory disparity between family and public banks today is similar to the disparity that existed a decade ago.

Under the current clinical operations of family cord blood banks, in which cord blood units are primarily released for sibling transplants or for autologous-use clinical trials, the world's largest family banks have achieved release rates between 10 and 100 per 100,000 inventory. We have previously published an excerpt of our report that calls out the rapid growth of sibling transplants for thalassemia in Asia, a situation where family cord blood banks are filling a public health need that is not adequately met by public banks. Our report also reviews the use of autologous cord blood therapy for pediatric brain injuries.

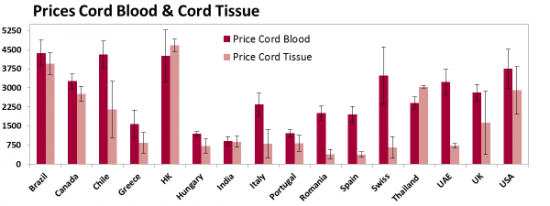

The biggest unique feature of our 2015 report is that we have compiled all the available prices for both cord blood banking and cord tissue banking, converted them to the same currency (USD), and performed numerous statistical studies to see how price is related to other banking parameters. Below is an excerpt of 20-year prices (processing & 20 years of storage) for selected countries that have 5 or more providers of family cord blood banking; the error bars are standard deviations.

This graph previews one of our conclusions: In European countries the price of cord tissue banking is usually half the price of cord blood banking, whereas in Asia & Oceania the prices of these two services are comparable.

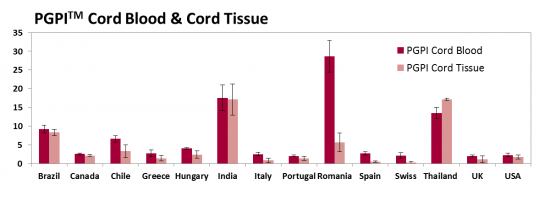

We have developed a new metric called the Parent's Guide Price IndexTM (PGPITM) that adjusts the price of family stem cell storage for the economy of the country where the provider does business. The PGPITM is defined as the ratio of the 20-year price for storing perinatal stem cells, divided by the annual income of households in the top 10% of the nation's GDP. The top 10% income in the denominator is intended to represent those households that are most likely to purchase family cord blood banking. Below we display the PGPITM of cord blood and cord tissue storage for the same set of selected countries, when possible.

While the absolute prices of cord blood storage are highest in North America and Western Europe, the PGPITM metric shows that in these countries cord blood and cord tissue storage are actually the most affordable, because 20 years of cord blood storage only costs 2% of the annual household income for families in the top 10%. The PGPITM of cord blood and cord tissue storage is about 8% in Latin America and close to 20% in some Asian countries. The underlying trend is that PGPITM is high in countries that have large income disparities.

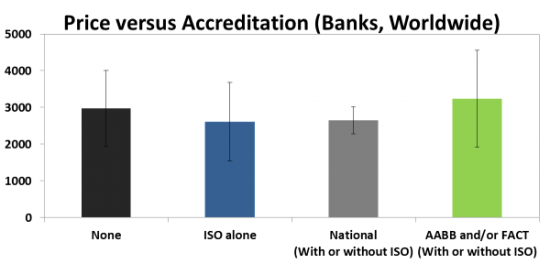

One of the biggest revelations in our report is that highly accredited family cord blood Banks do not cost consumers any more than Banks with no accreditation. The most common accreditation category for family cord blood Banks around the world is None, holding 36% of Banks. The other two large accreditation categories are ISO alone (holding any ISO accreditations) at 30%, and AABB and/or FACT (with or without ISO) at 28%. A 6% fraction of cord blood banks are accredited by National Authorities who require facility inspections. AABB and FACT are the only voluntary accreditations that are specifically designed for cord blood laboratories, thus we consider them to be the gold standards. Below are the average prices and standard deviations of these categories.

It turns out that there is no statistically significant difference between the average price of family cord blood Banks with None accreditation versus the AABB and/or FACT group. Cord blood laboratories that have attained the highest quality compliance are not passing their cost of accreditation on to consumers. Parents should be encouraged to select family banking providers that use laboratories with AABB and/or FACT accreditation, because there is usually no extra cost to choosing the highest quality.

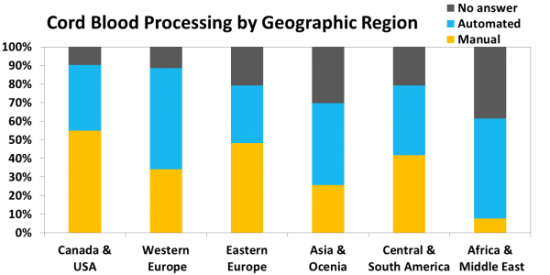

We surveyed family Bank laboratories about their cord blood processing and found that many continue to use the traditional manual methods, and in some countries those methods are dominant. We surveyed the Providers to find out which blood bags they are using for cord blood collections, and identified over 21 brands of bags. The type of bag most commonly named by Providers is "proprietary" bags, in which a cord blood company has taken a vendor's bag and customized it.

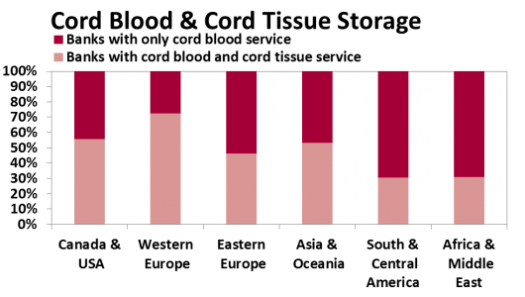

Regardless of whether or not Mesenchymal Stromal Cells (MSC) are "Ready for Prime Time", family storage of umbilical cord tissue has become a norm in this industry. Half of all family cord blood Banks now offer this service. The figure below shows that the availability of cord tissue storage varies geographically. At present 13% of those Banks offering cord tissue storage offer it as stand-alone service.

We found that offering cord tissue storage enables Banks to be more competitive: Those cord blood Banks that offer multiple stem cell storage services have significantly lower prices for cord blood storage alone. We also found that Banks who offer cord tissue storage tend to be more highly accredited for their cord blood storage; their most common cord blood accreditations are AABB and/or FACT at 40%, ISO alone at 28%, and None at 25%.

One chapter of our report is devoted to a survey of the cord tissue processing methods that are currently in use among family cord blood Banks, and a review of the literature supporting the various processing options. There is great deal of variation in the laboratory procedures and prices being offered for cord tissue storage. Roughly half of the Banks that process cord tissue are storing a tissue product (either whole or minced umbilical cord), and only a third of them are definitely storing isolated cells.

Managers of cord blood Banks who only operate in one region of the world may feel it is not a priority for them to be aware of all the international trends in our report. However, any Bank manager who is currently offering or plans to offer cord tissue storage would benefit from our survey of how other cord blood Banks are managing this emerging service and how their choices impact their ability to set prices.

We anticipate that the year ahead will bring significant changes to the landscape of cord tissue storage. We expect that more Banks will adopt tools from Miltenyi or AuxoCell that semi-automate cord tissue processing and produce more standardized products. AABB offers a somatic cell accreditation which can be used to accredit isolation of MSC from cord tissue. Those Banks that have this AABB accreditation can point to it as a discriminator, which will create market pressure for other Banks that store cord tissue to obtain accreditation for cell isolation activities and/or demonstrate that they have validated their protocols.